Table of Contents

Small Business: Legal Issues

- Nonprofit Law and Consultation

- Amy Hereford – JD, PhD

- 6400 Minnesota Ave – Saint Louis, MO 63111

- 314-972-4763 – amyhereford@gmail.com

Introduction

- Research and Planning

- Assemble Resources

- Establish Legal Foundations

- Establish Financial Systems

- Establish Compliance Systems

- Establish Communications & Development

- Find a Site and Begin Operations

- Business Plan – Executive Summary

Entrepreneurship

- Rewards

- Profit - Freedom from the limits of standardized pay for standardized work.

- Independence - Freedom from supervision and the rules of bureaucratic organizations.

- Satisfying Way of Life - Freedom from routine, boring, unchallenging jobs.

- Risks

- Uncertainty of income

- Risk of losing entire investment

- Long hours and hard work

- Lower quality of life until the business gets established

- Complete responsibility

- Success

- Passion

- Persistence

- High need for achievement

- Willingness to take measured risks

- Confidence and self-reliance

- High energy level

- Desire for responsibility

- Routes to Small Business

- Startup

- Buyout

- Franchising

- Family Business

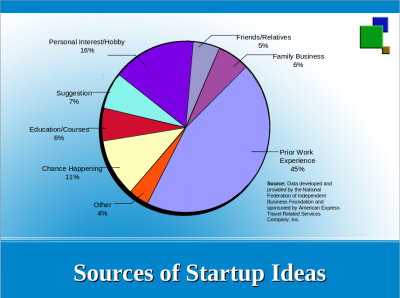

- Ideas for New Businesses

- New Market: Providing customers with a product/ service that is not in their market but already exists elsewhere.

- New Technology: Using a new technical process that provides the basis for new product or service ideas.

- New Benefit: Performing an old function for customers but in a new and improved way.

Business Plan

- The Mission Statement

- Important dates in beginning the business

- Names and roles of founders, key employees

- Location and description of site

- Description of services

- Funding sources

- Market highlights

- Strategic Development Plan for 1, 3, 5 years

Business Plan - Needs Analysis

- Define Market Segment

- Clearly define client/customer base

- How many potential clients are there?

- Where are they found?

- What are their characteristics?

- Identify other players

- Others providing similar services

- Others serving the same client base

- Similar service providers in other regions

Business Plan – Organization Description

- Overview of organization’s plan to meet the needs identified above

- Identify goods and services and describe how they will be provided

- Organization and Management

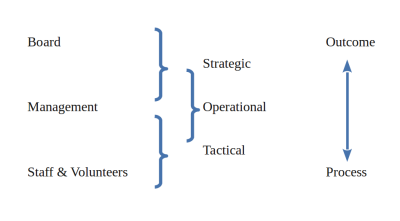

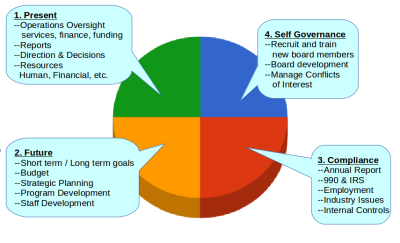

- Board Roles and Responsibilities

- Organizational Chart & Job Descriptions

Business Plan – Communication and Development

- Communication

- Create communication plan

- Develop methods of maintaining contact with

- Clients and potential clients

- Grantors and donors and supporters

- Financing

- Create Financing plan

- Identify sources of funding

- Identify development strategies to engage the community

Business Plan – Financials

- Financial Statements to Date

- Budget for start-up

- 3 months

- 6 months

- 1 year

- 2 years

- 3 years

Business Plan – Appendices

- Resumes of key managers

- List of Services

- Letters of reference

- Details of market studies / needs analysis

- Relevant bibliography

- Legal documents

- Articles, Bylaws, Corporate Minutes

- Copies of leases; Building permits; Contracts

- Licenses, Insurance, etc.

- List of business consultants and professionals

Budget

| Account | Startup | Year I | Year II |

|---|---|---|---|

| Income | . | . | . |

| Personal Funds | $5000 | . | . |

| Sales | $2000 | $15,000 | $30,000 |

| Expenses | . | . | . |

| Costs and Supplies | $2000 | $5000 | $7000 |

| Salary | $5000 | $10,000 | $23,000 |

Assemble Resources

- Based on Research and Planning

- Board Members

- Management

- Staff

- Funding & Resources

- Initial

- Development Plan

Crowdfunding

- Internet-facilitated fundraising

- Tax Laws still apply

- Charitable Solicitation Laws still apply

- Take account of costs and fees (3-15%)

- Equity, Loan, Gift

- Entrepreneur: wider exposure, risk loss of ideas or control

- Investor: many ideas, lack of due diligence

Establish the Legal Foundations

- Increasing burden of inter-related legal regulation

- Cost of these mistakes

- An attorney familiar with nonprofit law is an indispensable help in successfully meeting all these demands

- File with the State:

- Articles of Incorporation

- Articles of Organization

- Register a Partnership

- Draft operating document:

- Bylaws

- Operating Agreement

- Partnership Agreement

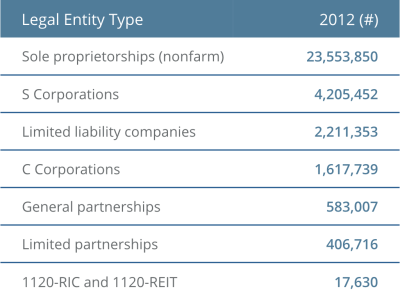

Forms of Ownership

- Sole Proprietorship

- Partnerships

- General

- Limited

- Corporations

- Regular Corporation

- Subchapter S Corporation

- Limited Liability Company

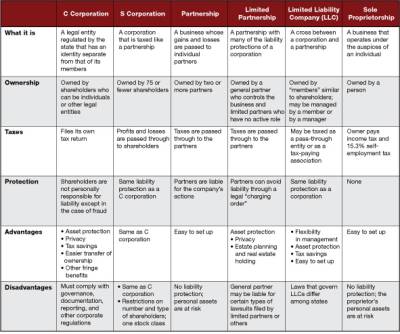

Choosing a Form

- Organizational costs

- Limited versus unlimited liability

- Continuity

- Transferability of ownership

- Management control

- Raising new equity capital

- Income taxes

Sole Proprietor

- A sole proprietorship is a business owned and operated by one person.

- There is generally no registration or filing fee.

- Liability is unlimited.

- The sole proprietorship is dissolved upon the proprietor’s death.

- Ownership of the company name and assets may be transferred.

- Management freedom is absolute.

- Capital is limited to the proprietor’s personal capital.

- Income from the business is taxed as personal income to the proprietor.

Checklist

- Business Name

- Decide on a Name

- Research for others using that name

- Consider fictitious name or DBA

- Consider Trademark Registration

- Set up for

- State Sales tax

- Personal State and Federal tax

- Estimated Tax Withholding

- Set up a Finances

- Accounting

- Payment / Creditcard / Invoicing

- Bank accounts

- Arrange for pension

- Obtain all necessary business licenses

- Obtain apppropriate insurance

- Establish relationships with professionals

- Business attorney

- Accountant

- Develop a checklist for ongoing Legal Compliance

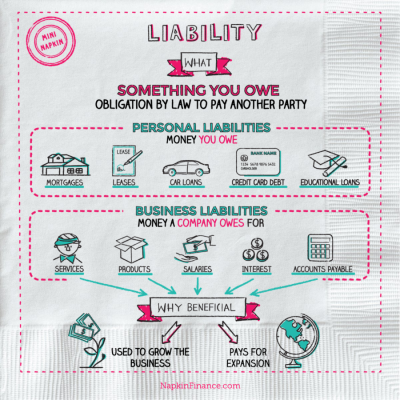

Liability

Partnership

- A partnership is a voluntary association of two or more persons to carry on, as co-owners, a business for profit.

- There is generally no registration or filing fee.

- Liability is unlimited.

- Unless the partnership agreement specifies otherwise, the partnership is dissolved upon withdrawal or death of a partner.

- Transferring ownership requires the consent of all partners.

- A majority vote of partners is required for control.

- Capital is limited by the partners’ ability and desire to contribute.

- Income from the business is taxed as personal income.

Limited Partnership

- Limited Partners invest in your business but are not otherwise active

- A written certificate must be filed with proper state office.

- Liability is limited to investment for limited partners.

- Withdrawal or death of limited partners does not affect the continuity of the business.

- Limited partners may sell their interest.

- Limited partners are not permitted any involvement in management.

- Limited partners’ limited liability provides a strong inducement in raising capital.

- Income from the business is taxed as personal income.

Checklist

- Name

- Decide on a Name

- Research for others using that name

- Consider fictitious name or DBA

- Consider Trademark Registration

- Set Up Partnership

- Record Partners names, ID#'s, record of ownership

- Set up partnership agreements

- Set up buy/sell - change in partnership interest agreements

- Establish contributions, payments, accounting, taxes for partners

- Establish

- Federal Tax ID#

- State Tax ID#

- State Sales Tax ID#

- State Unemployment, Withholding Tax ID#

- Apply for required operating permits, licenses, bonds, etc.

- Set up a Finances

- Establish appropriate accounting methods (tax year, cash vs. accrual, etc.)

- Set up acceptable bookkeeping system

- Establish expence procedures

- Set up bank / checking accounts

- Purchase Insurance

- Employees

- Personnel procedures / manual

- Establish Payroll procedures

- Establish relationship with professionals

- Bank

- Attorney

- Accountant

- Consider a business pension plan

- Develop a checklist for ongoing Legal Compliance

Partnership Agreement

- Name, Business and Location

- Term

- Capital - Contribution and ownership.

- Profit and Loss - How it is shared.

- Salaries and Drawings - No salary, but can draw on partner credit.

- Interest. No interest.

- Management Duties, Restrictions and Decisionmaking.

- Banking.

- Books. Accounting, access and fiscal year.

- Voluntary Termination. Distributions on termination to pay outstanding liabilities and obligations, then distribute to partners.

- Death.

- Disputes and Choice of Law - Any controversy or claim arising out of or relating to this Agreement, or the breach

Corporation

| Articles of Incorporation | Bylaws | EIN SS-4 | Licenses |

Articles of Incorporation and Bylaws

Articles of Incorporation

- Gives the organization a separate legal existence

- Filed with Secretary of State

- Generally a fill in form, but care must be taken in drafting purpose clauses

- Agreement with the state to establish and maintain the corporation: name, duration, location, registered agent, purpose, stock, amendment & dissolution

- Regular filing responsibilities, often overseen by secretary or treasurer

Bylaws

- Law for the Corporation

- Board Governance

- Purpose

- Board qualifications, terms and succession

- Board powers and responsibilities, meaningful oversight of staff – purposes, activities, financials

- Meetings, notice, decisionmaking

- Reporting requirements

- Financial structure

- Officers qualifications, terms and succession

- Committees

- Amendment and dissolution

Subchapter S Corporation

- It is taxed as a partnership.

- Eligibility requirements are as follows:

- No more than 75 stockholders are allowed.

- All stockholders must be individuals or qualifying estates and trusts.

- Only one class of stock can be outstanding.

- The corporation must be a domestic one.

- No nonresident alien stockholders are permitted.

- The S corporation cannot own more than 79 percent of the stock of another corporation.

- Benefits

- Tax Savings. No double tax

- Business Expense Tax Credits. Some business expense writeoffs.

- Independent Life. Keeps Business separate from life.

Checklist

- Name

- Decide on a Name

- Research for others using that name

- Consider fictitious name or DBA

- Consider Trademark Registration

- Set Up Corporation

- File Articles of Incorporation

- Adopt Bylaws for the Corporation

- Determine who will be Directors and Officers

- Set up and issue Stock

- Establish Corporate Minutes books

- Set up shareholder agreements (if more than one active owner)

- Set up buy/sell stock redemption agreement

- Arrange for any asset / liability transfers to corporation

- Apply for Subchapter S, if applicable

- Establish

- Federal Tax ID#

- State Tax ID#

- State Sales Tax ID#

- State Unemployment, Withholding Tax ID#

- Apply for required operating permits, licenses, bonds, etc.

- Set up a Finances

- Establish appropriate accounting methods (tax year, cash vs. accrual, etc.)

- Set up acceptable bookkeeping system

- Establish expence procedures

- Set up bank / checking accounts

- Purchase Insurance

- Employees

- Personnel procedures / manual

- Establish Payroll procedures

- Establish relationship with professionals

- Bank

- Attorney

- Accountant

- Consider a business pension plan

- Develop a checklist for ongoing Legal Compliance

Develop a Corporate Record-keeping System

- Records System

- Board, Management and Staff Records

- Finanical records

- Management

- Compliance (tax, grants, etc)

- Record Creation and Use

- Access and confidentiality

- Storage

- Security

- Record Retention and Destruction

- Legal implications

- When and How

State and Local Requirements

- Income Tax (state)

- Sales Tax (state and local)

- Property Tax (local)

- Franchise Tax, etc. (state and local)

- Licenses

Missouri

- Articles of Incorporation (SOS)

- Apply for sales tax ID from the state (DOR)

- Annual Report (SOS) (AG)

Local Regulatory Issues

- Business licenses and permits

- Licensing and insurance of professionals

- Business license

- Check Secretary of State website

- Zoning laws and municipal regulations

- Check city, county, municipal offices for necessary permits, regulations, zoning issues.

Employment and Payroll

- Federal Employment Laws

- State Employment Laws

- Industry Employment Requirements

- Payroll

- Exempt vs Nonexempt Employees and Overtime

- Withholding Accounting and Payment

- Employment Handbook

Intellectual Property

- Offensive and Defensive

- Trademark exclusively identifies the source or origin of products or services

- Copyright is a set of exclusive rights regulating the use of a particular expression of an idea or information

- Patent is a set of exclusive rights granted by a state for a fixed period of time which is new and useful

Checklist for Corporate Legal Compliance

- Board Meetings and Minutes

- Annual Filings

- Federal Tax

- State Corporate filings

- State Tax

- Permits, licenses

- Municipal filings and tax

- Financial and Audit Requirements

- Employment

- Contracts and Insurance

Policies and Procedures

- Staff Policies and Procedures

- Staff Record Management Policies and Procedures

- Staff Budget and Financial Policies and Procedures

- Employment Policies

- Staff Training Policies

- Client Services Policies and Procedures

- Character of Policies and Procedures

- Clear, useable and available to staff

- Managerial and organizational

- Drafted to anticipate and prevent legal problems.

Establish Financial Systems

- Develop an accounting system and budget.

- Gone are the days of shoe box accounting.

- Professional help in this area is important.

- Board Financial Management must ensure appropriate

- Oversight, recordkeeping and reporting.

Find a Site and Plan to Begin Operations

- All the hard work begins to pay off in services offered to clients.

- Ensure Policy / Procedures Compliance

- Ensure Recordkeeping

- Regularly review operations

- Update policies and procedures as required

Legal Duties

- Duty of Care: Take reasonable care when making decisions for the organization, be competent

- Duty of Loyalty: Act in the best interest of the organization, confidentiality

- Recusal: Stand aside when there is a conflict of interest

- Duty of Obedience: Act in accordance with the organization’s mission, public trust

Board Governance

LLC

Limited Liability Company

- Limited liability for owners

- Taxed as a partnership

- Easier to establish, manage and control than corporations

- Now in all 50 states

- Limited transfer of ownership

- May be cumbersome to share or transfer ownership (unanimous written consent)

Checklist

- Name

- Decide on a Name

- Research for others using that name

- Consider fictitious name or DBA

- Consider Trademark Registration

- Set Up LLC

- File Articles of Organization with the State

- Adopt operating agreement

- Agree on ownership, capital contribution, profit-sharing

- Establish

- Federal Tax ID#

- State Tax ID#

- State Sales Tax ID#

- State Unemployment, Withholding Tax ID#

- Apply for required operating permits, licenses, bonds, etc.

- Set up a Finances

- Establish appropriate accounting methods (tax year, cash vs. accrual, etc.)

- Set up acceptable bookkeeping system

- Establish expence procedures

- Set up bank / checking accounts

- Purchase Insurance

- Employees

- Personnel procedures / manual

- Establish Payroll procedures

- Establish relationship with professionals

- Bank

- Attorney

- Accountant

- Consider a business pension plan

- Develop a checklist for ongoing Legal Compliance

Operating Agreement

- Introductory matters: formation, regulation of internal affairs, limitation of authority of a member, power to contract debts, use of legal company name, registered office/agent, record-keeping

- Start-up matters: maintenance of record book, establishment of bank accounts, reimbursement for organizational expenses, and LLC certificate

- Members: initial members, capital contributions and withdrawals, membership interests, admission of additional members, certificates of membership interest, and limitations of member liability and responsibility

- Management and control of the business including elections, annual/special meetings, officers, managers, and powers

- Capital accounts

- Allocations of net profits, net losses, and distributions

- Accounting, records, and reporting

- Transfer and assignment of interest

- Dissolution, winding up, and disassociation events

- Indemnification

Six Agreements

1. Operating Agreement / Bylaws

- identification of the owners;

- board of directors;

- voting rights;

- allocation of profits and losses;

- meeting times and places,

- owners' rights and obligations;

- addition of new owners;

- the right to sell or transfer stock or membership interests, and

- amendment and dissolution

2. Buy / Sell Agreement

- value of the company;

- family members able and willing to succeed;

- compensation of non-involved partners/family;

- income for spouse/dependent children;

- transfer of ownership outside partners/family;

- tax planning;

- funding; and

- when, why, how quickly

3. Contracts with vendors and customers

- goods/services,

- price,

- timeline,

- payment terms,

- breach and remedies.

4. Promissory notes, guarantees, security, releases

5. Corporate Minutes

- attendees,

- reports,

- elections of officers,

- resolutions

6. Non-compete, Non-disclosure, Confidentiality

- subject matter,

- geographic scope,

- timeframe,

- breach and remedies

Dissolution & Winding Down

- Close the Business As Required your Organizing Documents

- File with the State

- Notify the IRS and State and Local Tax Agencies

- Plan the Closing of Operations

- Cancel Business Licenses

- Terminate Contracts

- Notify Customers / Clients

- Liquidate Stock, Supplies and Equipment

- Plan staffing / severance

- Notification to Creditors

- Settle Creditor Claims

- Collect Money Owed to the Business

- Inform Other Stakeholders About the Closure

- Sell and Distribute Your Assets

- Meet with a Business Attorney Before You Dissolve Your Business